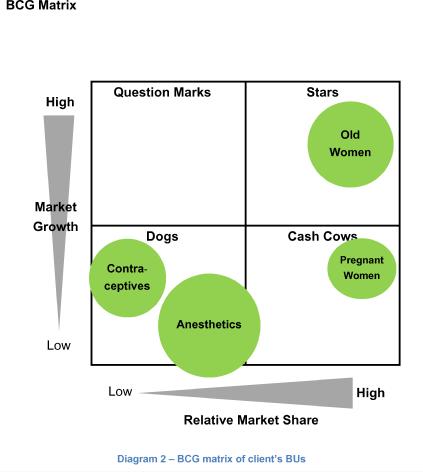

So if Samsung has a 20 percent market share in the mobile phone industry and Apple (its largest competitor) has 60 percent so to speak, the ratio would be 1:3 (0.33) implying that Samsung has a relatively weak position. The exact measure for Relative Market Share is the focal company’s share relative to its largest competitor. The creator of the BCG Matrix used this variable to actually measure a company’s competitiveness. Where do you put most of the money and where should you perhaps divest? The BCG Matrix uses Relative Market Share and the Market Growth Rate to determine that.īCG Matrix Video Tutorial Relative Market Share However even in a well balanced product portfolio, corporate strategists will have to make decisions on allocating money to and distributing money across all of those business units. This helps Samsung to cope with the financial setback elsewhere. In case something might happen to the camera industry for instance, Samsung is still likely to have positive cash flows from other business units in other product categories. This is a smart corporate strategy to have because it spreads risk among a large variety of business units. Samsung sells phones, cameras, TVs, microwaves, refrigerators, laundry machines, and even chemicals and insurances. Samsung is a conglomerate consisting of multiple strategic business units (SBUs) with a diverse set of products. This article will cover each of these categories and how to properly use the BCG Matrix yourself.įigure 1: BCG Matrix BCG Matrix Example: Samsung’s Product Portfolio

Depending on how well the unit and the industry is doing, four different category labels can be attributed to each unit: Dogs, Question Marks, Cash Cows and Stars.

The main purpose of the BCG Matrix is therefore to make investment decisions on a corporate level. By combining these two variables into a matrix, a corporation can plot their business units accordingly and determine where to allocate extra (financial) resources, where to cash out and where to divest. BCG Matrix (also known as the Boston Consulting Group analysis, the Growth-Share matrix, the Boston Box or Product Portfolio matrix) is a tool used in corporate strategy to analyse business units or product lines based on two variables: relative market share and the market growth rate.

0 kommentar(er)

0 kommentar(er)